ETH Price Prediction: Technical Breakout and Fundamental Catalysts Point to Continued Gains

#ETH

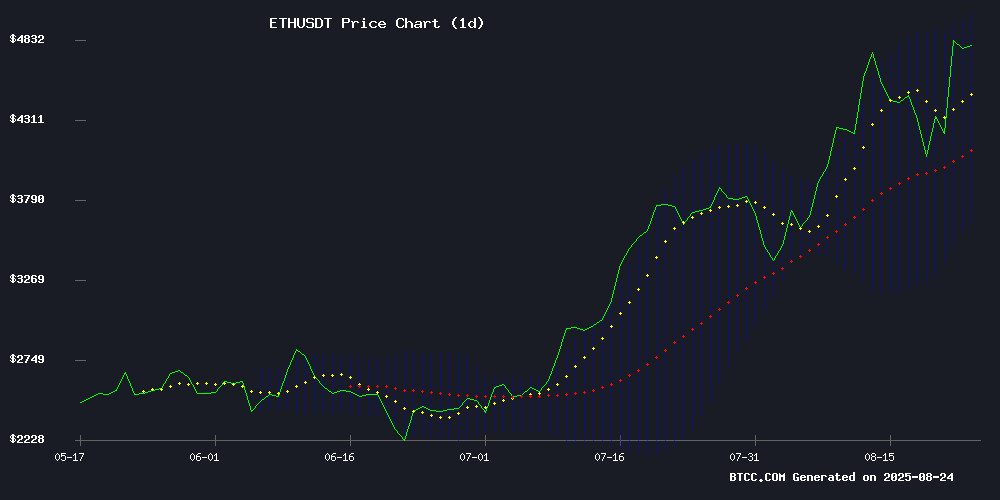

- ETH trading 10.7% above 20-day moving average indicates strong bullish momentum

- BlackRock's $287M ETF inflows and Emirates adoption provide fundamental support

- Approaching Bollinger Upper Band at $5,005 suggests potential breakout opportunity

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

ETH is currently trading at $4,787.76, significantly above its 20-day moving average of $4,325.91, indicating strong bullish momentum. The MACD reading of 9.94 shows positive momentum building, though the negative values in the MACD components suggest some underlying caution. The price is approaching the upper Bollinger Band at $5,004.87, which may act as resistance. According to BTCC financial analyst Mia, 'ETH's position above the 20-day MA and middle Bollinger Band suggests continued strength, with a break above $5,005 potentially triggering further upside.'

Market Sentiment: Institutional Adoption and ETF Flows Drive Optimism

Positive news flow continues to support ETH's bullish case. Emirates Airlines' adoption of ethereum for flight bookings demonstrates real-world utility, while BlackRock's $287M surge in spot Ether ETFs indicates strong institutional demand. Arthur Hayes' $20,000 prediction and the US government's $281M ETH addition provide additional bullish catalysts. BTCC financial analyst Mia notes, 'The combination of institutional ETF flows, major corporate adoption, and influential bullish forecasts creates a fundamentally supportive environment for ETH's continued appreciation.'

Factors Influencing ETH's Price

Ethereum Price Faces Key Resistance As US Government Adds $281M ETH

Ethereum posted a 70% quarterly gain, its strongest performance since early 2021, as institutional interest grows. The US government now holds over $281 million in ETH, signaling widening adoption despite price volatility.

Critical support lies between $4,500-$4,700, with the RSI nearing 70 indicating stretched momentum. Analysts note such consecutive gains are rare—historically preceding major bull cycles when they occur.

The asset's 45% drop and subsequent 36% recovery earlier this year exemplify its volatility. Market watchers view consolidation phases as necessary groundwork for sustained uptrends.

Ether Nears Record Highs as Bullish Forecasts Spotlight ETH Exposure Strategies

Ether (ETH) is trading near all-time highs at $4,783, fueled by institutional adoption and bullish projections. Fundstrat's Tom Lee predicts ETH could reach $15,000 by end-2025, citing Ethereum's expanding role in stablecoins, DeFi, and real-world asset tokenization.

Direct ownership remains the purest play, offering full access to Ethereum's ecosystem. Meanwhile, spot ETH ETFs are emerging as a regulated gateway for traditional investors, with staking proposals pending approval.

BlackRock Fuels $287M Surge in Spot Ether ETFs, Reversing Outflow Trend

U.S. spot Ether ETFs snapped a four-day outflow streak with $287.6 million in net inflows on Thursday, led by BlackRock's iShares Ethereum Trust (ETHA) attracting $233.5 million. Fidelity's Ethereum Fund (FETH) followed with $28.5 million, signaling renewed institutional confidence after $924 million in withdrawals earlier in the week.

The rebound pushes cumulative net inflows past $12 billion, with ETFs now holding 6.42 million ETH (5.31% of circulating supply) worth $27.66 billion. This concentration underscores Ethereum's growing footprint in regulated investment vehicles despite recent volatility.

Emirates Airlines Adopts Ethereum for Flight Bookings as ETH Price Rebounds

Ethereum's real-world utility expands as Emirates Airlines becomes the latest major corporation to integrate crypto payments. The Dubai-based carrier will now accept ETH for flight bookings, signaling growing institutional adoption of Web3 technologies. Analyst That Martini Guy ₿ called the move "massive" for bridging traditional commerce with decentralized finance.

The announcement coincides with Ethereum's market recovery, with ETH gaining over 20% from recent lows. At press time, the asset trades at $4,743.25 despite a 1.55% dip in the past 24 hours. Trading volume remains robust at $84.66 billion, underscoring sustained investor interest.

This development marks a strategic convergence of travel infrastructure and blockchain ecosystems. Emirates' decision follows a broader trend of blue-chip companies incorporating crypto payment options, particularly in sectors with high international transaction volumes.

Arthur Hayes Predicts Ethereum Could Reach $20,000 Amid Anticipated Quantitative Easing

Ethereum's recent all-time high is just the beginning, according to BitMEX founder Arthur Hayes. He now forecasts a surge to $10,000-$20,000 this cycle, citing potential large-scale quantitative easing under a Trump administration as the catalyst. The prediction was shared on the crypto Banter podcast ahead of Jerome Powell's Jackson Hole speech.

Hayes argues that breaking through all-time highs creates momentum for further gains, particularly as digital asset treasury companies find it easier to raise capital in a rising market. His bullish stance reflects broader optimism about institutional adoption and macroeconomic tailwinds for crypto assets.

7 Smart Hacks for Reducing NFT Gas Fees

High and unpredictable gas fees remain a major cost barrier in the NFT and DeFi ecosystems, turning potential profits into financial drains for collectors and creators alike. The volatility of these fees stems from blockchain's computational demand, where gas acts as the fuel for transactions like minting, trading, or transferring NFTs.

Strategic timing, data-driven decisions, and emerging technologies offer pathways to mitigate these costs. By understanding market forces and adopting proactive measures, users can transform gas fees from a punitive tax into a manageable expense.

SharpLink Gaming Launches $1.5B Buyback Program to Strengthen Ethereum Holdings

Nasdaq-listed SharpLink Gaming (SBET) has unveiled a $1.5 billion stock repurchase initiative aimed at bolstering its Ethereum reserves. The Minneapolis-based firm now holds 740,000 ETH, valued at $3.5 billion, following aggressive crypto acquisitions.

The buyback program is designed to narrow the gap between SBET's share price and its net asset value (NAV), which has lagged despite Ethereum's rally above $4,700. Co-CEO Joseph Chalom emphasized the strategic nature of the move, noting that share repurchases during periods of discounted valuations prove accretive to shareholders.

The flexible plan carries no obligations and can be paused at any time. SharpLink's approach reflects growing institutional confidence in Ethereum's long-term value proposition amid volatile market conditions.

Ethereum Nears $4,900 as ETF Inflows and Fed Policy Fuel Rally Hopes

Ethereum briefly touched $4,885 on August 22, marking a historic high as Jerome Powell's Jackson Hole speech spurred optimism about potential rate cuts. The rally reflects renewed institutional confidence, with Ethereum ETF inflows reaching $12.7 billion in 2025.

Technical indicators reveal a mixed outlook. While ETH's price action suggests strength, bearish divergences in RSI and on-balance volume caution against unchecked optimism. Analysts debate whether the current momentum can sustain a breakout toward $10,000 targets.

Institutional demand remains a key driver. BlackRock's growing involvement underscores Wall Street's deepening interest in Ethereum's potential, even as traders watch for confirmation of trend continuation or reversal.

BlackRock Sparks $287M Ether ETF Rebound After Sharp Outflows

U.S. spot Ether exchange-traded funds (ETFs) reversed a four-day outflow streak with a $287.6 million influx, led by BlackRock's iShares Ethereum Trust. The rebound signals renewed institutional confidence as cumulative net inflows surpass $12 billion.

Corporate treasuries now hold 4.10 million ETH worth $17.66 billion, with SharpLink emerging as a major accumulator. This institutional accumulation raises fresh debates about Ethereum's decentralization as ETF reserves now represent 5.31% of circulating supply.

The market movement follows Tuesday's $429 million withdrawal - one of the largest single-session outflows this month. Fidelity's Ethereum Fund captured $28.5 million of the inflows, while other issuers combined for $6 million.

Ethereum Price Surges to Record High Amid Strong Technicals and ETF Inflows

Ethereum's price soared to an all-time high of $4,877 on August 23, continuing a bullish trajectory that began in April when it bottomed at $1,383. The rally follows Federal Reserve Chair Jerome Powell's remarks at the Jackson Hole Symposium, which bolstered market sentiment.

Technicals underscore the momentum. ETH retested and held a critical support level at $4,093—December 2021's peak—before completing a break-and-retest pattern, a classic bullish signal. The asset remains firmly above its 50-day and 100-day moving averages, with the Supertrend indicator flashing green.

ETF inflows added fuel. Resuming on Thursday and accelerating Friday, institutional demand reflects growing confidence in Ethereum's long-term value proposition. Market capitalization now stands at $572 billion, cementing ETH's dominance in the altcoin market.

Coinpedia Digest: This Week’s Crypto News Highlights | 23rd August, 2025

Federal Reserve Chair Jerome Powell struck a cautious tone in his final Jackson Hole speech, hinting at potential rate cuts while emphasizing inflation risks. "We will not allow a one-time increase in the price level to become an ongoing inflation problem," Powell declared, acknowledging the delicate balance between monetary easing and price stability.

Ethereum surged to a record $4,878 following Powell's remarks, overtaking Mastercard's market capitalization. The rally reflects institutional demand, with spot Ethereum ETFs now managing $20 billion in assets. "Ether is being seen as the backbone of future finance," observed ETF analyst Nate Geraci, underscoring its growing role in corporate treasury strategies.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, ETH appears to be a compelling investment opportunity. The price trading above key moving averages combined with strong institutional ETF inflows and major adoption news creates a positive investment thesis.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $4,787.76 | Strong bullish position |

| 20-day MA | $4,325.91 | Price well above support |

| Bollinger Upper | $5,004.87 | Near-term resistance target |

| MACD Signal | 9.94 | Positive momentum building |

| ETF Inflows | $287M (BlackRock) | Strong institutional demand |

BTCC financial analyst Mia suggests that while short-term resistance around $5,000 may cause some consolidation, the combination of technical strength and fundamental catalysts supports a positive medium to long-term outlook for ETH investors.